Marinade DeFi Series Part 4: Volatile mSOL Trading Pairs

Welcome back, chefs!

Today’s recipe is on providing liquidity for volatile mSOL trading pairs. These strategies have important differences compared to being an LP for mSOL-SOL, so we will cover all the potential risks and benefits. Let’s dive right in!

If you haven’t already, be sure to check out part 3 of this series.

Volatile Trading Pairs

First, let’s clarify what we mean by a “volatile trading pair”. A trading pair is considered volatile when the values of its assets have a low correlation. In other words, their prices do not tend to move together.

Next, let’s break down an LP’s source of profits and losses (PnL). By looking at each component, we can see how being an LP for a volatile pair fares relative to being an LP for a stable pair.

The PnL for being an LP can be expressed as a combination between trading fees, emissions, and impermanent loss (IL):

PnL = trading fees + emissions - IL

Let’s consider each of the factors contributing to PnL.

The price of assets on AMMs are determined by the ratio of assets in its pool. There is no mechanism for valuing assets based on their “true” price. Since the values of the tokens are not tied together in any way (the way that SOL and mSOL are, for example), it is easy for the prices implied by the pool’s ratio to diverge from the “true” prices due to trading on other exchanges.

If an asset is heavily bought on other exchanges, the price of the asset will have increased, but the AMM will have no way of knowing about this. The only way that the pool’s ratio can be brought back to the “correct” ratio that reflects the “true” price is by arbitragers buying the asset on the AMM (where the price is low) and selling it on other exchanges (where the price is high).

What this ultimately means is that volatile trading pairs will tend to have greater trading volumes because there will be more opportunities to arbitrage the pool. Volatile pairs also tend to have higher fees, typically 0.3% for volatile pairs vs 0.06%~0.04% for stable pairs depending on the exchange.

In sum, trading fees tend to be larger for volatile trading pairs.

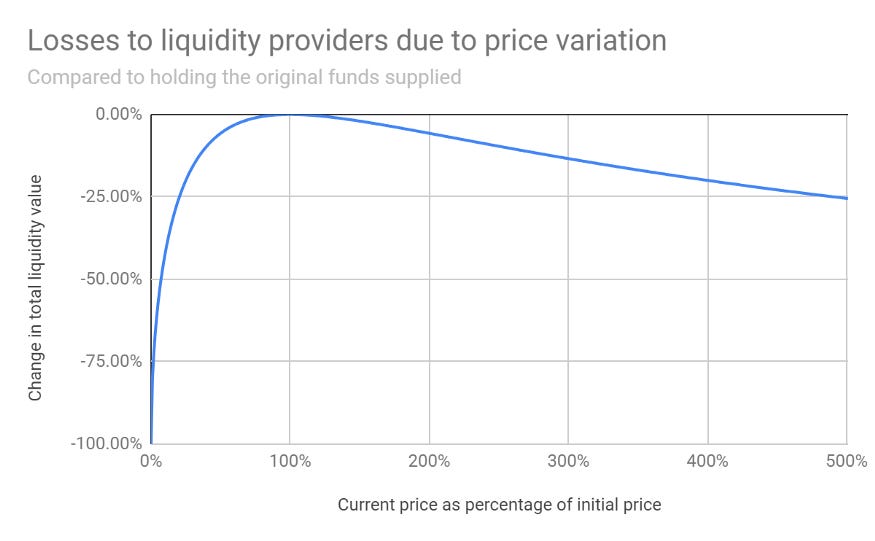

Next, let’s consider emissions and IL together, since they are directly related. The more volatile a trading pair, the more IL it is likely to experience. For this reason, volatile trading pairs tend to be incentivized with greater emissions; otherwise, users will be unwilling to provide liquidity. Greater risk = greater rewards.

Choosing a Pair

In choosing which pair to LP for, you want a pair that is less volatile (less IL), has more trading fees, and has higher emissions. The decision is almost never straightforward because, as explained earlier, more volatile pairs (more IL) tend to have more trading fees and higher emissions. Given that none of the factors can be predicted ahead of time, you will have to make an estimated guess. With experience, and by considering all the relevant variables, you will become better at choosing which pairs to become an LP for.

Perhaps most importantly, be sure that you are comfortable having exposure to whatever asset mSOL is paired with. We’re assuming you’re holding mSOL because you are bullish on SOL. But if you are bearish on the paired token, then you expect mSOL to increase in value while you expect the paired token to decrease in value, which means IL! Of course, if the potential trading fees and emissions are significant, they may be enough to overcome the IL. Unfortunately, there is no easy way to determine whether this is the case.

Understanding IL

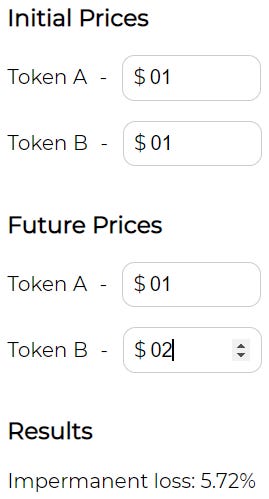

You can, however, train your intuition for how much IL matters by using this IL calculator. For example, suppose mSOL doubles in price relative to the other token you are an LP for. The IL calculator shows that this results in an IL of 5.72%

Suppose your APR for being an LP is 100% (assume no compounding for simplicity of calculation). How many days of being an LP do you think it would take for you to break even relative to just holding the two assets? Take a moment to think about this and test your intuition. I’ve posted the answer as a footnote at the bottom of this article.1

Current Opportunities

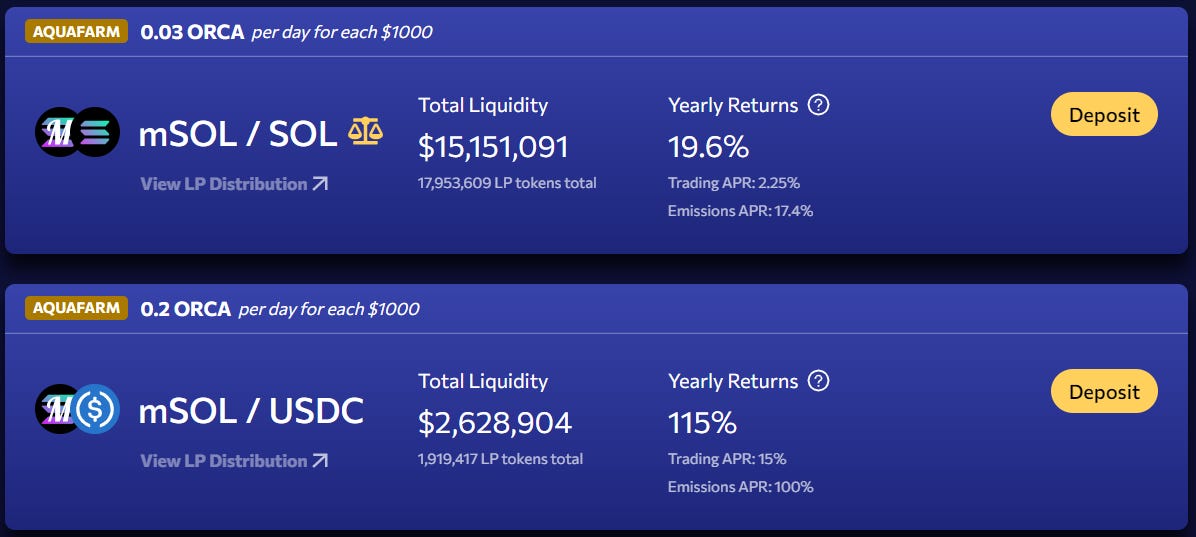

The currently available volatile mSOL trading pairs are mSOL-USDC on Raydium and Orca, mSOL-RAY on Raydium, and mSOL-ORCA on Orca. Marinade recently began emitting their governance token MNDE for various DeFi activities involving mSOL, and being an LP for mSOL trading pairs is no exception.

Right now, mSOL-ORCA on Orca has a slightly higher APY than mSOL-USDC on Raydium. Aside from the higher APY, there is another reason that I would generally recommend choosing mSOL-ORCA over mSOL-USDC: mSOL can be expected to have a higher correlation with ORCA than with USDC and, consequently, will have less IL. There is no guarantee that this will be the case, but in general volatile tokens that do well will tend to move together. So unless you have a specific reason to be bearish on ORCA, providing liquidity for mSOL-ORCA may be the optimal choice here.

Keep in mind that due to users shifting liquidity between pools and incentive structures being changed, APYs are constantly changing. If you want to optimize your yield farming for volatile mSOL trading pairs, you’ll have to constantly keep an eye on the available opportunities.

Conclusion

Volatile trading pairs come with greater risk due to IL, but they also provide a chance of higher returns from trading fees and emissions.

In our next article, we will be covering lending and borrowing with mSOL, a strategy that provides a lot of flexibility in defining your risk profile.

Until then, happy cooking!

This content should not be construed as financial advice. Always do your own research before investing in crypto assets and using DeFi protocols.

Follow @TheSolanaUpdate or subscribe to this newsletter to never miss an update.

The answer is approximately 5.72/(100/365)=21 days.